Condo Insurance in and around San Jose

Condo unitowners of San Jose, State Farm has you covered.

Insure your condo with State Farm today

- Silicon Valley

- SF Bay Area

- California

- San Jose

- Los Gatos

- Campbell

- Morgan Hill

- Gilroy

- Los Angeles

- Palm Springs

- San Diego

- Monterey & Carmel

- Saratoga

- Monte Sereno

Calling All Condo Unitowners!

There is much to consider, like deductibles providers, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a tough decision. Not only is the coverage remarkable, but it is also competitively priced. And that's not all! The coverage can help provide protection for your condo unit and also your personal property inside, including things like linens, cookware and books.

Condo unitowners of San Jose, State Farm has you covered.

Insure your condo with State Farm today

State Farm Can Insure Your Condominium, Too

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo unit from a hailstorm, theft or a tornado.

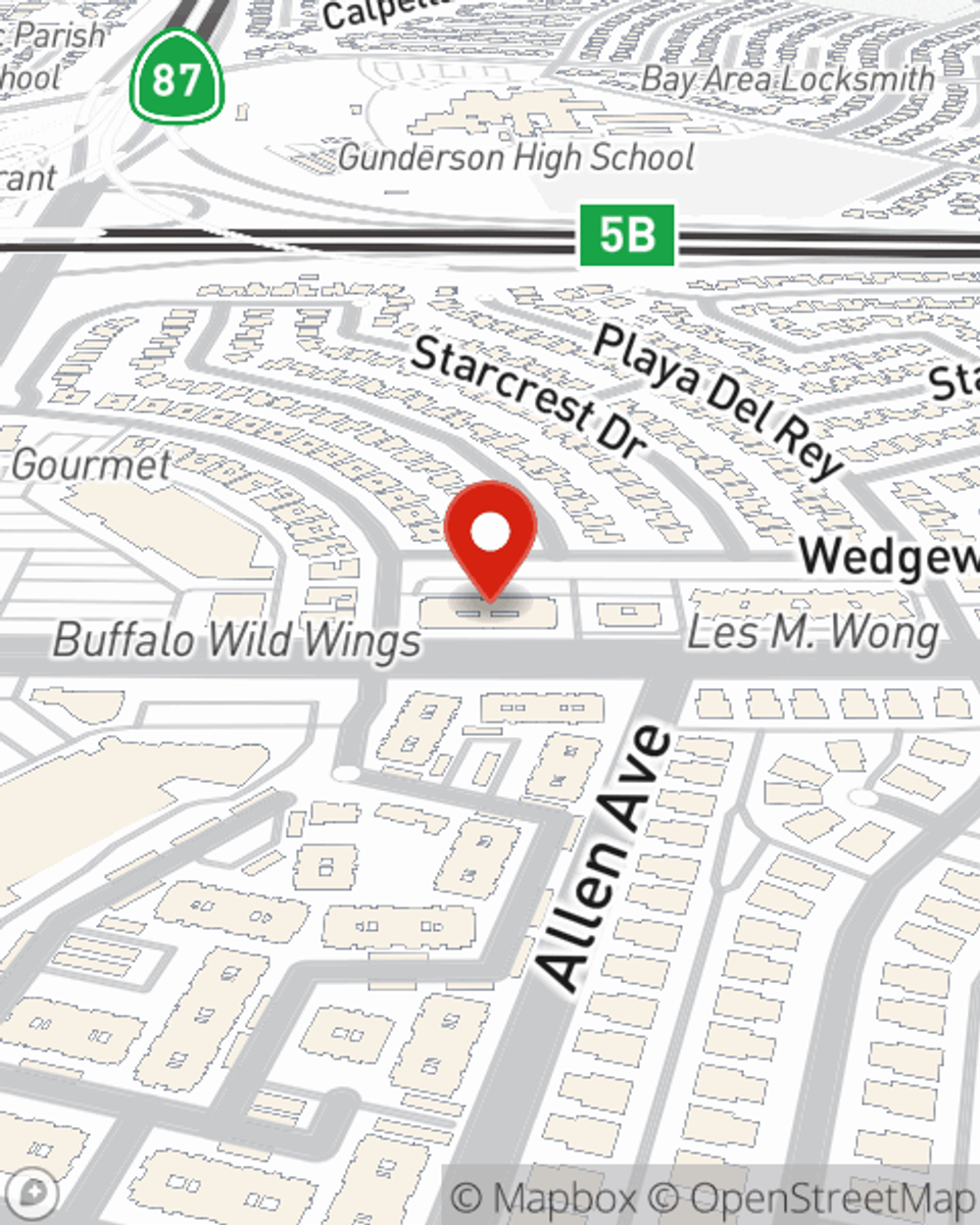

Intrigued? Agent Steve Sosnowski can help clarify your options so you can choose the right level of coverage. Simply reach out today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Steve at (408) 629-4700 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Steve Sosnowski

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.